In the dynamic world of multifamily real estate investing, few factors wield as much influence over property values as interest rates. Recent shifts in these rates have prompted significant changes in the multifamily housing market, reshaping investment strategies and buyer expectations.

While today's interest rates are in-line with historical averages, they seem exceptionally high due to the long period of time that they were recently kept low. The availability of cheap debt over the last decade was a large driver for investor demand for multifamily real estate. This, among other things caused asset values to increase - many times beyond what would otherwise make sense.

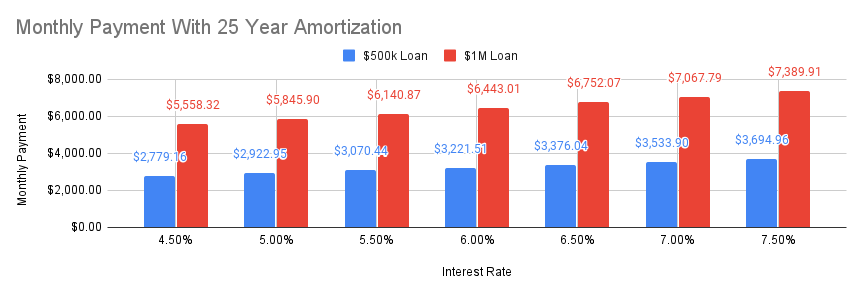

Now, with interest rates back at average levels, we're witnessing a decline in transaction volume as buyers grapple with higher borrowing costs. As you can see in the chart below, the difference between a $1,000,000 loan with a 4.5% interest rate compared to a 7.5% interest rate is $1,831.59 per month.

This could mean the difference between positive cash-flow and negative cash-flow. No investor wants to pour money into a property month after month just to keep it afloat.

This extra monthly expense needs to come from somewhere.

Most banks have a requirement for borrowers to maintain a certain Debt Service Coverage Ratio (DSCR). A number often used is 1.2x. The DSCR is calculated by dividing the annual net operating income (NOI) by the annual debt service. So if a multifamily property has an NOI of $30,000 and an annual debt service of $25,000 then it will be able to meet the 1.2x DSCR minimum.

If a property does not meet the bank’s DSCR requirements then there are two main solutions

- Reduce the amount of debt

- Increase the NOI

In a new purchase the buyer can’t control the in-place NOI, so they may be required to significantly increase their down payment. The days of financing a real estate investment with a modest 25% down payment are mostly behind us. Today’s buyers are often asked to put 30-50% down, which has a direct impact on their cash-on-cash returns.

The result is fewer buyers that are willing to pay last year's sale prices. While every buyer has their unique business plan and investment goals, the majority seem to agree that multifamily properties should be able to produce positive cash flow while supporting reasonable debt payments.

So, where does this leave property owners contemplating a sale in the next 12-36 months? The key lies in optimizing your NOI by increasing revenue and decreasing expenses.

Consider implementing strategies such as:

- Rental Revenue Optimization: Evaluate market rents and consider adjustments where appropriate.

- Implementing amenities or services that justify higher rents can also be beneficial.

- Expense Reduction: Scrutinize operating expenses and identify areas for cost-saving measures. Negotiate with vendors, explore energy-efficient upgrades, and streamline maintenance processes.

- Value-Add Initiatives: Invest in property improvements or renovations that enhance the overall appeal and value of the asset. Upgrading common areas, improving curb appeal, or adding desirable amenities can elevate your property's marketability.

- Tenant Retention: Focus on tenant satisfaction and retention strategies to minimize vacancy rates and ensure consistent cash flow.

By proactively managing your property's NOI, you can mitigate the impact of rising interest rates and maximize its value in the eyes of potential buyers. While the current market conditions present challenges, they also offer opportunities for savvy investors to position themselves for long-term success.

Interested in a free property performance analysis? Contact John Stiles today!