That which gets tracked has the opportunity to be improved.

That's why it's important to identify Key Performance Indicators (KPIs) that you can keep an eye on in your multifamily rental business. Whether you are managing your properties yourself, you've hired a third party management company or you have internal staff - KPIs will help you monitor what's happening in your business and allow you to adjust accordingly.

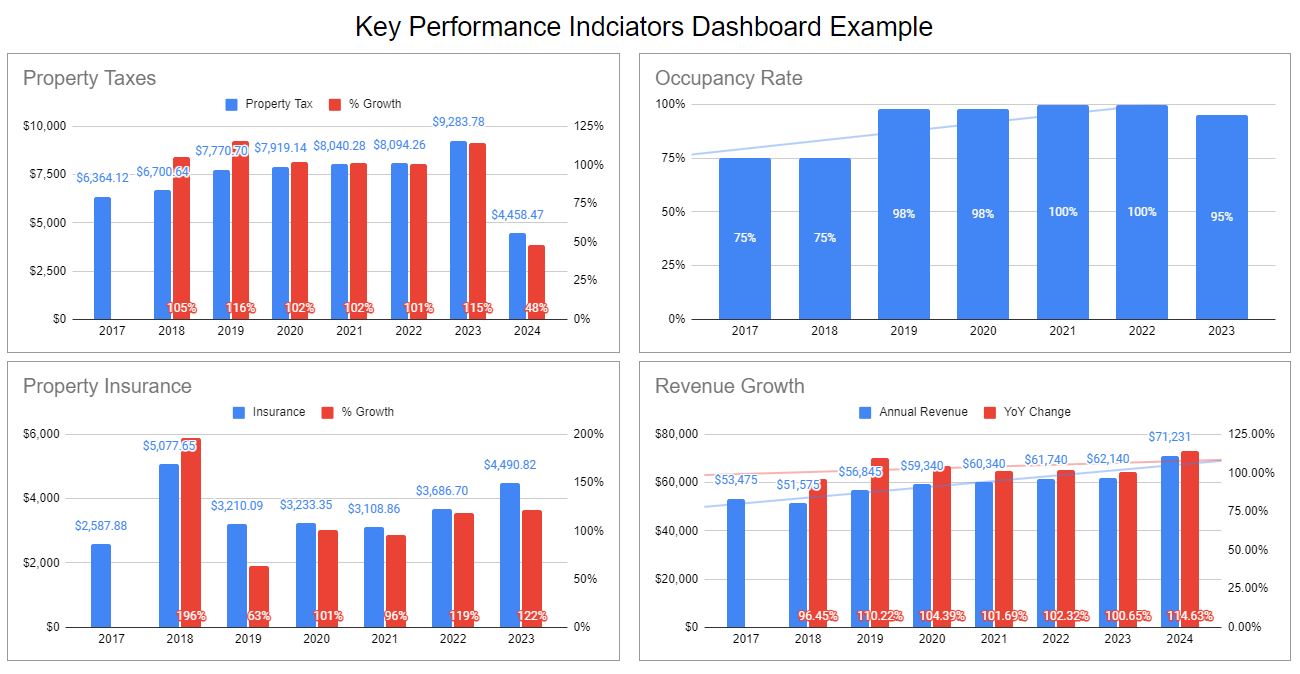

You can have KPIs related to occupancy, revenue, expenses, maintenance response times and more. Armed with that data, you can make intelligent adjustments to maximize your property value.

KPIs can track leading and lagging indicators. Or another way to think about these terms is:

- Things that you can directly control (leading)

- Things that you can’t directly control (lagging)

Leading indicators with multifamily rental properties are things like:

- Average response time to resolve non-emergency maintenance requests. This KPI indicates how well you are maintaining your property. It will also influence the customer satisfaction of your residents which will influence the likelihood of them renewing their lease and spreading good reviews about your business. Depending on how you’re doing with this KPI you may be attracting and retaining tenants or tenant retention might be an issue you need to resolve.

- Average response time to new rental inquiries. When you’re advertising an available rental unit you are in the sales business. You need to think about the customer experience and try to set yourself apart from the competition. There are times in the market cycle when renter demand is high and you won’t be forced to pay as close attention to this. But if you find that it’s taking a long time to fill a vacancy, then this is one KPI you can look to for a possible solution.

- Average length of time it takes to process a lease application. Related to the previous KPI, this is another thing you should focus on, if attracting and retaining great tenants is important to you. If you take a long time to respond to a rental application, that person may seek housing elsewhere. You don’t want to lose out on a great resident just because you were busy doing other things and hadn’t gotten back to them. If you find that it is taking longer than usual to process an application, then you might need to adjust staffing, reconsider job descriptions or investigate if there is technology that can help you to automate tasks.

- Average money spent on advertising a rental unit. This KPI has a direct impact on both your top line revenue and your expenses. You don’t want to be wasting money on advertising if it isn’t necessary. However if you find your occupancy rate is dropping and the time it takes to fill a vacancy is increasing then you should take a look at this.

While you can likely find some cross-over between leading and lagging indicators, it’s important to take a moment to consider: is this an item that I can directly control? If not, then are there other actions I could take to indirectly control the outcomes of the following lagging indicators?

Lagging indicators with multifamily rental properties are things like:

- Average occupancy / vacancy over the trailing 12 months. Occupancy is key to a successful rental business. If your units aren’t occupied then you’re hardly in business. While the current occupancy may or may not look great - it’s a good idea to track this on a rolling 12 month basis. That way you can constantly be checking what your annual occupancy rate is and compare that to the same metric for the previous month or the previous year. Together you can determine if there are any trends that should influence your approach to pricing vacant units and your overall marketing strategy.

- Average occupancy length of all residents that have moved out. This KPI can help you get a sense of how you are doing with tenant retention. While there are numerous reasons why residents move and many (if not most) are out of your control - there are several things that you can control such as pricing, property condition, maintenance response times, and general customer service. If you are having too many turnovers and you can’t seem to keep residents more than 1 - 2 years at a time, then you might want to take a look at your approach to these areas.

- Average occupancy length of all residents that are still in the property. Related to the previous KPI, this statistic can also help you budget for future turnovers and capital improvements. If you have current residents that have been in your property for 10 or more years, then it’s likely those rental units will need significant updating when the resident eventually moves out. Chances are you, the current rent is well under market rent and you are likely losing potential revenue on this unit.

- Average number of showings to fill a vacancy. When it takes your leasing staff (or yourself) dozens of trips to your property in order to meet potential residents, time is being wasted and in this business - time is money. You’ll have to do further investigation to see if it’s a matter of pricing, property condition or the pre-screening process that is implemented before scheduling a showing. Your strategy with these items will cause the leasing team to have an easy or difficult time. The more streamlined you can make their job, the better they’ll be able to focus on establishing a positive relationship with your potential residents.

- Average length of time to fill a vacancy. Related to the previous KPI, here you’ll be tracking the number of days you need to fill a rental unit. This can help you determine how soon to start advertising a rental unit once you know it is going to be available.

- Average cost per turnover. In general, landlords try to avoid turnovers due to the cost of cleaning, and upgrades necessary in order to fill the unit again. But how much are those costs? Do they change drastically if the previous resident has been there for 3 years versus 6 years? If you have this data handy you can better budget for these upcoming expenses and reduce the amount of stress due to the unknown.

- Annual percentage increase in property taxes and insurance. These expense items are almost always going up. If you have a good understanding of the percentage of increase each year you will be better equipped to decide when it makes sense to shop insurance or make a property tax value appeal. Additionally you will have real data to back up any necessary rent increases that you pass on to your residents.

- Average rent payment date. Rent is due on the 1st isn’t it? If the majority of your residents are paying on the 5th or later you either have an issue with how you are explaining expectations or you have an issue with the type of residents you are attracting.

- Average credit score of accepted rental applicants. Related to the previous KPI, this metric will help you understand the type of residents you are attracting. From there you can see how important a certain credit score may be to your screening criteria and how much a person’s credit influences the likelihood that they’ll be a good resident at your property.

For those data nerds out there, the options of what could be tracked are limitless.

But of course we’re not in the data business - we’re in the rental business!

So take a moment and pick the KPIs that are most important to you. Depending on the size of your business and the issues that you are currently facing, you may decide that some KPIs are more relevant now and later you might focus on others.

Consider creating a dashboard where you can easily and quickly get a snapshot of how your rental business is performing. Make a point of periodically updating your data so that you can continue to track your progress and make adjustments where necessary. Here is an example.

The risk of not tracking KPIs is that you will likely miss something and your business will suffer. Like everything else in life, a business left to itself will break down. Without tracking KPIs you may not notice the downward trend happening right under your nose.

If you’d like a free Rental Property Business Plan Review then contact John Stiles today. Together we can identify which KPIs you need to track in the next 12 months and how we can maximize your property value!